- Home

- News

- Features

- Topics

- Labor

- Management

- Opinions/Blogs

- Tools & Resources

Working in America: Having A Secure Job Is A Path To The Middle Class

By Wendy Wang, Pew Research Center–Americans believe that having a secure job is by far the most important requirement for being in the

middle class, easily trumping homeownership and a college education, according to a new nationwide Pew Research Center survey of 2,508 adults.

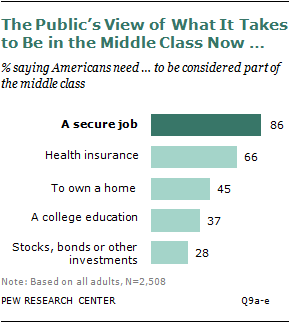

Nearly nine-in-ten adults (86%) say a person needs a secure job to be considered part of the middle class, while just 45% say the same about owning a home, 37% about a college education and 28% about financial investments.

Of the five items tested in the survey question, the only other one seen as essential to a middle-class lifestyle by a majority of the public is health insurance—which for many Americans comes through one’s job. Two-thirds of adults say it’s an essential ticket to a middle-class life.

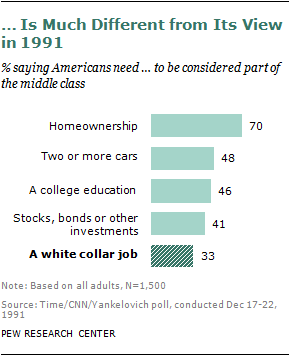

The public’s view about what it takes to be in the middle class appears to have changed dramatically over the past two decades.

In a 1991 nationwide Time/CNN/Yankelovich survey, seven-in-ten respondents said homeownership was essential to being in the middle class, while just one-third said the same about having “a white collar job.”

Some of the sharp differences between the public’s responses in 2012 and 1991 are likely the result of wording differences between the two surveys: “a white collar job” (the wording used in the 1991 survey) is arguably a less inclusive and compelling a choice than “a secure job” (the wording used in the 2012 survey).

But some of the variance may also reflect the persistently high unemployment rates of the past four years as well as a longer-term decline in the share of the working-age public that is employed.

Fewer Americans Are Employed

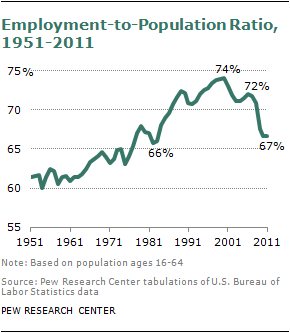

The share of the population ages 16 to 64 that is employed fell to 67% in 2011, its lowest level since 1983, when it was 66%. 2

This decline began about a decade ago and ended a 50-year period during which an ever-rising share of people were working, a trend fueled largely by the entry of women into the workforce. The share peaked around 2000, when 74% of the nation’s population ages 16 to 64 was employed.

The decline began during a shallow recession in the early 2000s and then accelerated with the Great Recession of December 2007-June 2009 and the sluggish recovery since.

From 2006 to 2011, the share of Americans ages 16 to 64 who are employed dropped from 72% to

67%, the steepest five-year decline since 1948, the first year for which employment data are available from the U.S. Bureau of Labor Statistics (BLS).

During the past 60 years, the trend lines for men and women on these employment measures could hardly be more different. The employment rate for men ages 16 to 64 was nearly 90% at the beginning of the 1950s and has since dropped to 71% in 2010-11, its lowest rate in modern times.

Women’s employment rates started from a much lower base—36% at the beginning of the 1950s—and rose steadily for a half century until they peaked at 68% in 2000.

Since then they have dropped to 62%, as the recession took a heavy toll on workers of both genders. The decade from 2001 to 2011 was the first in the modern era when women ages 16 to 64 have not made gains in employment rates over the prior decade.

Middle Class Demographic Trends & Employment

Even though men and women have experienced a different trajectory in their employment rates, they are equally likely to say a secure job is something Americans need to be in the middle class (85% for men vs. 88% for women). Their views on health insurance, owning a home and financial investments are also similar.

One exception is in the area of education: Women are more likely than men to say that a college education is needed to be considered part of the middle class (40% vs. 34%).

The importance of a secure job and health insurance for the middle class is accepted by Americans of all races. But adults of different races and ethnicities differ in their views about other things. Compared with blacks and whites, Hispanics put higher values on homeownership (63%), a college education (61%) and investments such as stocks or bonds (46%).

Blacks are less likely than Hispanics to view these items as necessities to the middle class but are more likely than whites to think so.

In general, Americans ages 50 and older are more likely than younger Americans to value health insurance as a middle-class criterion (71% vs. 61%). But the youngest adults—those ages 18 to 24—also strongly believe that Americans need health insurance to be in the middle class (70%), and they are more

likely than older and middle-aged adults to say the same about a college education (47% vs. 35%).

Homeownership Less Important To Middle Class

Homeownership is a marker of a middle-class lifestyle that has significantly dropped in importance over the past two decades.

In 1991, 70% of adults said owning a home was important to being in the middle class; today, just 45% feel this way. The decline has occurred across the board, among old and young, men and women, people with different educational attainment.

During most of the 1990s and early 2000s, home values rose steadily, but after the housing bubble burst in 2006, home prices fell by about 30% and have not recovered. The share of the public that owns a home has also declined.

List your business in the premium web directory for free This website is listed under Human Resources Directory